Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

Cash solutions

Grow your savings with the best investment solution for you with our range of local and international cash solutions with competitive interest rates.

If you need certainty when investing your savings and want to enjoy competitive interest rates, we offer a wide range of local and international cash solutions. These include Nedbank fixed-term and notice deposits, income funds and dividend-yielding solutions.

Connecting you to a range of local and international solutions.

Our global reach, local presence and banking scale enable you to protect your savings. Whether you need immediate access to your money or are happy to leave it to grow, we can connect you to a range of local short-, medium-, and long-term options to meet different savings and investment goals. These include different rates of return and levels of liquidity, underlying investment exposure and return certainty.

Short-, medium- and long-term savings and investment options

Many options provide capital protection and a preferential interest rate if you invest online or through our app.

When you need access to your money. |

The rate of return you want to earn on your money. |

|

| What is important to you? |

|

This generally depends on how long you can leave your money with us and/or how much you invest. |

| Ways to achieve this | Some savings options are more flexible in terms of:

|

There is a range of rates of return. These may be:

|

| Potential returns and risks | The less flexible options compensate you with a higher rate of return. Nedbank fixed deposits give you full capital protection and guaranteed rates. |

|

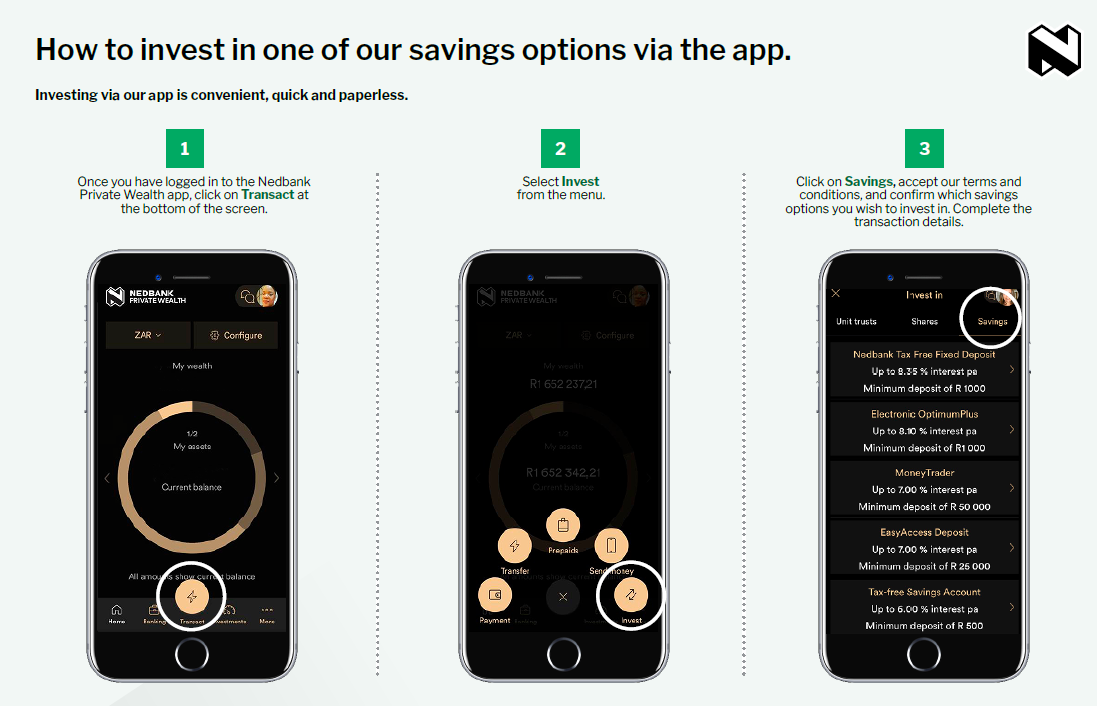

Connecting you to a range of options with preferential rates when you invest via the app.

You can get exclusive Nedbank Private Wealth savings and investment solutions at your convenience via the Nedbank Private Wealth app.

- To find out more about the benefits and features of the app and to download it, click here.

- To view the superior savings and investment options available on the app, click here.

| International fixed-term and notice deposits are just a click away with our Focus Account. |

Accessing information about or transacting with your international wealth is only a click or phone call away with Focus – our integrated international banking and investment wealth platform. The Focus Account offers a range of banking services that include fixed-term deposits to suit your needs. |

| Looking for an income from our high-yielding unit trust and dividend income options? |

We offer a diversified range of local and international income solutions. These include:

Each of the investment options have different minimums, goals, time frames for investing, withdrawal limits, and other features and benefits, including tax efficiency and diversified exposure to underlying market investments that enable you to achieve a desired risk–return profile. |