Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

June 2025 market review: South Africa

The South African economy showed marginal growth in Q1 2025, with real GDP increasing by just 0.1%. Read the latest market review.

Unity Tested, GNU in Focus

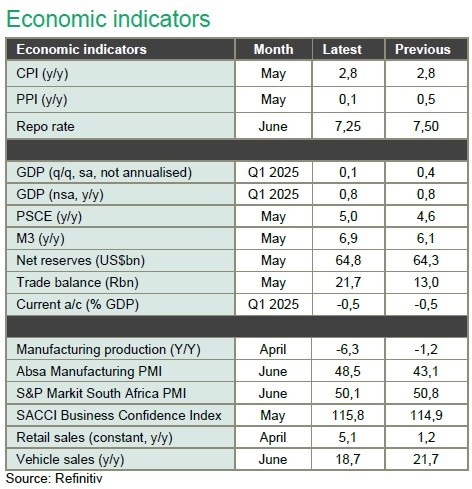

The economy showed marginal growth in Q1 2025, with real GDP increasing by just 0.1%, down from 0.4% in Q4 2024. Growth was primarily driven by the agriculture, forestry, and fishing sectors, resulting in modest year-on-year growth of 0.8%. The private sector economy showed signs of fragility in June, as the S&P Global PMI remained barely within expansion territory. In addition, business confidence fell to its weakest level in almost four years. The current account deficit narrowed to R35.6 billion in Q1, compared to R39.3 billion in Q4 2024. This improvement was also supported by the improved terms of trade (including gold) as the rand price of exported goods and services increased by more than that of imports. According to data from NAAMSA, the vehicle market grew for the ninth consecutive month in June, with year-to-date sales up 13.6%, as South Africans continue to visit showrooms, driven by declining interest rates and an influx of affordable brands.

In June, President Cyril Ramaphosa unexpectedly dismissed DA Deputy Minister Andrew Whitfield for failing to obtain prior approval for an international trip taken in February. The decision has heightened tensions within the Government of National Unity (GNU), particularly between the ANC and the DA. While the party chose not to exit the GNU, it withdrew from the National Dialogue and refused to support budget allocations for ministers accused of corruption.

Headline inflation for the year ending May 2025 printed at 2.8%, unchanged from the previous reading and slightly above market expectations. The main contributors were housing and utilities, while transport saw annual deflation of 4.8%, driven by a 14.9% year-on-year drop in fuel prices. Core inflation, which excludes volatile food and energy prices, remained steady at 3.0%, indicating stable underlying inflation pressures. Producer inflation slowed to 0.1% in May from 0.5% in April, below expectations due to weaker output in food, beverages, and tobacco products. The Reserve Bank is reviewing the current 3-6% inflation target range and has published a detailed report, emphasizing that now is an opportune time to consider a change. While market participants generally support lowering the target, opinions differ on the costs of achieving it. The market now awaits a response from the National Treasury.

In the second quarter of 2025, domestic assets delivered positive returns, with bonds underperforming equities. The FTSE/JSE All Bond Index rose by 5,9% over the quarter. The rand strengthened by 3.1% against a weaker US dollar to R17.7 but declined by 5.4% against a stronger euro. The FTSE/JSE SA Listed Property Index gained 9.1%, while the FTSE/JSE All Share Index increased by 10.2%.

The Software and Computer Services sector was the primary contributor, returning 20.8%, with Naspers and Prosus gaining 22.1% and 17.8%, respectively, following strong earnings reports. Prosus’s Capital Markets Day left investors optimistic about the new management team’s focus on improving the profitability of the company’s broader investment portfolio. In contrast, the Pharmaceuticals and Biotechnology sector had a weaker quarter, declining by 25.8%, driven by Aspen. Precious metals continued to perform strongly, delivering a year-to-date return of 78.2%, driven by a resilient gold price, while platinum miners benefitted from a shift in investor demand for alternatives.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.