Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

July 2025 market review: International

Global markets entered the second half of 2025 with momentum. Read the July 2025 international market review.

Certainty in Uncertain Times

Global markets entered the second half of 2025 with momentum. Tech stocks led the rally, driven by Nvidia becoming the world’s first $4 trillion company, followed closely by Microsoft, whose cloud services boosted demand for AI offerings.

US lawmakers passed the $3.4 trillion One Big Beautiful Bill Act (OBBBA) just ahead of the self-imposed Independence Day deadline. The bill extends the 2017 tax cuts and allocates new funding for immigration enforcement and military spending. US labour market data showed signs of cooling, with US job openings falling to 7.4 million, led by declines in hospitality, healthcare, and finance, while retail, government and education saw modest gains.

US inflation data highlighted increasing evidence of the inflationary impact from tariffs, with goods inflation showing upward pressure. US CPI rose to 2.7% year-on-year in June, with a 0.3% monthly increase, in line with expectations.

However, core CPI was softer at 0.2% month-on-month. The US Fed’s preferred inflation measure, core PCE, rose to 2.8%, marking the second consecutive monthly increase and remaining above the central bank’s 2.0% target. In the UK, headline CPI rose to 3.6% year-on-year, driven by transport costs, while core CPI increased to 3.7%. Services inflation remained unchanged at 4.7%.

Central banks remained cautious. The US Federal Reserve held rates steady for the fifth consecutive meeting, maintaining the benchmark range at 4.25%–4.5%. Notably, two governors dissented, marking a rare split. The Bank of Japan kept its policy rate unchanged at 0.5%, but revised inflation forecasts upward due to rising food costs and stronger wage growth. In Europe, the ECB paused its rate-cutting cycle, holding its benchmark rate at 2.0%, citing stabilised inflation and slowing wage growth.

Globally, economic signals were mixed. In the US, GDP rebounded in Q2 2025, growing 3.0% year-on-year after a 0.5% contraction in Q1 – the first decline in three years. The rebound was largely driven by a sharp drop in imports, reversing a surge in Q1 as businesses and consumers stockpiled ahead of anticipated tariffs. Consumer spending supported growth, while fixed investment weakened. China’s GDP grew 5.2%, supported by strong exports despite trade tensions, though domestic demand and property sector weakness continued to drag. Producer prices in China fell 3.6% year-on-year, the steepest decline in nearly two years. The IMF has revised its global GDP growth forecast for 2025 to 3.0%, up from its April projection, citing improved economic conditions.

Bond markets reflected shifting expectations. 30-year US Treasury yields rose above 5% as markets digested the higher inflation figures and the fiscal implications of OBBBA. Japan’s 30-year bond yields also climbed above 3%, reflecting similar concerns around inflation and policy normalisation. The Bloomberg Global Aggregate Bond Index declined 1.5% for the month, as rising yields weighed on fixed income performance. Meanwhile, the US Dollar Index, which measures the dollar’s performance against a basket of major currencies, strengthened 3.2% in July, driven by dollar demand as new trade agreements came into effect.

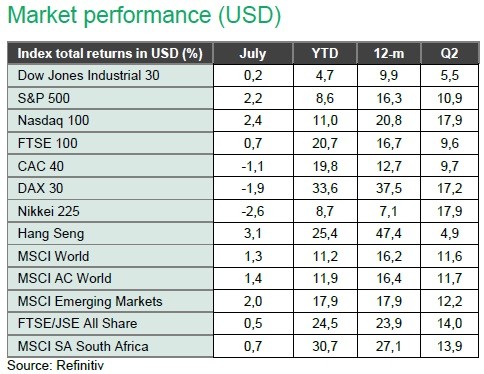

The MSCI All Country World Index rose 1.4%, with emerging markets outperforming developed markets. The MSCI EM Index returned 2.0%, while Japan’s Nikkei declined 2.6% in July. In Europe, performance was mixed, UK’s FTSE 100 led with a 0.7% USD return, while Germany’s DAX declined 1.9% and France’s CAC 40 declined 1.1%.

Commodities saw mixed performance. Brent crude oil rose by 7.3% in July 2025, despite OPEC+’s announcement of a planned production increase. Gold declined 0.4% amid dollar strength but remains up 25.4% year-to-date. Among PGMs, platinum fell 5.0% in July, palladium rose 8.3%, and rhodium surged 32.4%. Copper initially rallied on supply concerns and tariff fears but dropped 18% after the US announced a 50% tariff limited to semi-finished products, triggering a sharp correction. Copper ended the month down 2.6%.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.