Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

June 2025 market review: International

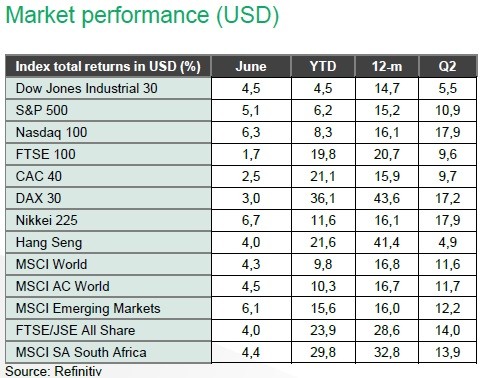

Global equities posted strong gains in the second quarter, with the MSCI All Country World Index rising 11.7%. Read the latest market review.

Turning the Tide

The US equity market reached an all-time high in the second quarter of 2025, despite elevated geopolitical risks. The S&P 500 Index has fully rebounded from an 18.8% drawdown in April, which followed President Donald Trump's announcement of “Liberation Tariffs”.

In the Middle East, a 12-day conflict that began mid-June with Israel targeting Iran's nuclear facilities pushed oil prices above $80 per barrel before they eventually fell back to $67. A ceasefire brokered by the US, helped ease tensions between the two nations. This development, along with a preliminary trade agreement between China and the US, shifted market sentiment toward a risk-on stance. The proposed deal would grant the US access to rare earth elements critical for advanced technologies, while the US would lift restrictions on certain goods entering China. The agreement is currently awaiting approval from both governments.

Meanwhile, at the NATO Summit held on June 25, member states agreed to increase defence spending to 5% of GDP from 2% by 2035. This decision was greatly influenced by renewed pressure from President Trump, who emphasized the need for greater burden-sharing among allies.

US inflation in May rose less than expected, coming in at 2.4% year-on-year versus April’s 2.3%. Core CPI, which excludes volatile food and energy prices, remained steady at 2.8% year-on-year. The index favoured by the US Federal Reserve (US Fed), the core Personal Consumption Expenditures index, rose 2.7% year-on-year, exceeding expectations. The US economy contracted by 0.5% in Q1 2025, as trade tensions weighed on business activity. China’s manufacturing PMI inched up to 49.7 in June from 49.5 in May, signalling a modest improvement in industrial activity. However, the index remains below the 50-point threshold that separates expansion from contraction, indicating that the recovery is still fragile.

On central bank policy, there was some diverging actions. The Bank of England held interest rates steady at 4.25% on June 19, while the European Central Bank (ECB) continued its easing cycle, cutting interest rates by 25 basis points. The ECB’s decision was driven by easing inflation pressures, an improved economic outlook, and a desire to support growth. This marked the ECB’s eighth interest rate cut over the past year, reducing rates by a cumulative 2% since June 2024. The People’s Bank of China kept its interest rates unchanged in June after a cut in May, which marked the first-rate reduction since October 2024. This move is part of a broader monetary easing campaign by Beijing aimed at supporting a cooling economy and addressing risks stemming from trade tensions with the US. At its June meeting, the US Fed held rates steady but revised its forecasts, raising its inflation outlook and lowering its growth expectations for 2025.

Global equities posted strong gains in the second quarter, with the MSCI All Country World Index rising 11.7%. Emerging markets outperformed developed markets, with the MSCI EM Index returning 12.2%. Japan’s Nikkei rose 6.7% in June, bringing quarterly gains to 17.9%, despite concerns over the impact of US tariffs. European equity markets delivered mixed results, Germany’s DAX was the best performer in USD returning 17.2% for the quarter, while UK’s FTSE 100 returned 9.6%.

Bond markets were volatile during the quarter, influenced by geopolitical tensions. In addition, the deterioration in fiscal metrics implied by the budget reconciliation bill under consideration kept US long bond yield under pressure. The US Dollar Index fell by 7.0% over the quarter against a basket of major currencies, as investor sentiment was shaken by recent Trump administration policies. The Bloomberg Global Aggregate Bond Index returned 4.5% for the period. In commodities, gold rose 5.7% during the quarter, as investor interest shifted toward alternatives such as platinum group metals (PGMs). Platinum surged 36.2%, supported by a sharp increase in Chinese imports.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.