Accessibility Links

By browsing our website, you accept the use of cookies. Our use of cookies is explained in our privacy policy.

May 2025 market review: International

In line with expectations, the US Federal Reserve kept policy rates on hold in May. Read the latest international market review.

Uncertainty a reliable constant

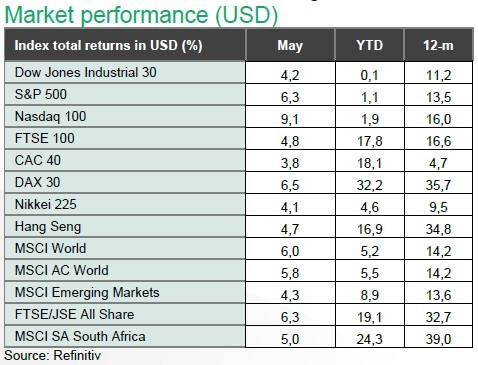

Progress on trade negotiations set the tone for a strong showing from global risk assets in May, further supported by quarterly US earnings and global economic data that appears resilient for the time being. US technology stocks benefitted from improved sentiment, but also credible first quarter financial results from Nvidia. The company’s share price rose 24,1% over the month but returns year to date are paltrier at 0,6%. The UK and US agreed a trade proposal that saw the 10% minimum tariff retained, cut tariffs on aluminium and steel and moderated taxes on the first 100 000 cars entering the US. Following a constructive meeting in Geneva, the US and China agreed to partially lower reciprocal tariffs imposed on one another for 90 days to allow for negotiations, deescalating tensions between the countries. This leaves current effective tariffs on China at 30% and 10% on the US. Neither country has been immune to the uncertain backdrop. The US printed economic growth of -0,2% in the first quarter as importers frontloaded purchases, while China recorded lower factory activity in the last few prints.

With a semblance of stability returning to markets, the oil price rose by 1,2% over the month, bringing the decline year to date to -14,4%. OPEC+ members announced a hike to supply for a third consecutive month, unwinding cuts made during 2022. Talks between Russia and Ukraine stalled with President Putin notably absent from a meeting in Turkey on the topic. Attacks between the countries intensified after the meeting.

President Trump furthered his ambitions to extend tax cuts and deliver on other campaign promises. The US House of Representative passed the One, Big Beautiful Bill Act, a budget package which now moves to the Senate for approval. The current version sees a meaningful increase to debt and the debt ceiling, lower than anticipated expenditure cuts and changes to Medicaid that concern party members on both sides.

The last of the major credit ratings agencies to do so, Moody’s downgraded the US credit rating to Aa1 from Aaa. While this has little practical implications at this stage, it reflects on both the fiscal trajectory in the US and the growing view that US assets are not as failsafe as once perceived. US long duration bonds saw weak auctions while US long bond yields, a gauge for fiscal risk, edged higher, breeching the 5,0% mark during the month.

US headline inflation eased to 2,3% from 2,4% y-o-y in April, while core inflation remained unchanged at 2,8%. Producer prices slowed to 2,5% from 3,4% the previous month, printing below expectations. Data for the US personal consumption expenditure price index (PCE) declined to 2,1%, while the annual rate for core PCE (the Fed’s preferred measure of inflation) also decreased to 2,5%. Markets continue to watch inflation prints closely for early signs of pricing pressure post implementation of tariffs, although it is arguable too early to see meaningful change. US consumer surveys showed little improvement in May, with uncertainty an overhang. In line with expectations, the US Federal Reserve (US Fed) kept policy rates on hold in May. Minutes form the meeting, released later in the month, highlighted difficult trade-offs with risks to both US Fed’s goals of inflation and employment. Inflation for the Euro area printed at 2,2% y-o-y in April, just above the 2% inflation target. Markets are expecting another interest rate cut from the European Central Bank (ECB) in June. In contrast, UK inflation increased to 3,5% from 2,6% in March, with a notable increase in energy costs while wage costs also showed upward pressure. The Bank of England (BoE) cut interest rates by 25bps in a divided vote with two members voting for a hold. Chinese inflation printed at -0,1% y-o-y, the third month of deflation while core inflation remained steady at 0,5%. Producer prices continued to languish in deflationary territory, falling by 2,7% y-o-y in April.

Global sovereign bonds edged lower over the month as markets digested duration risk, with the Bloomberg Global Aggregate Bond index returning -0,4%. With conciliatory tones soothing market concerns, the upward trend in the gold price lost traction with the yellow metal delivering flat performance over May. The US dollar returned -0,1% in May, bringing the decline year to date to 5,1% on a trade weighted basis.

Want to know more?

Here's what to do:

- Contact your wealth manager or stockbroker.

- To find out more about our investment offering, click here.

- If you're interested in what we can offer you, we would love to hear from you. You can contact us on 0800 111 263, or complete an online contact form.

| Disclaimer |

Nedgroup Private Wealth (Pty) Ltd and its subsidiaries (Nedbank Private Wealth) issued this communication. Nedgroup Private Wealth is a subsidiary of Nedbank Group Limited, the holding company of Nedbank Limited. ‘Subsidiary’ and ‘holding company’ have the same meanings as in the Companies Act, 71 of 2008, and include foreign entities registered in terms of the act. There is an inherent risk in investing in any financial product. The information in this communication, including opinions, calculations, projections, monetary values and interest rates, are guidelines or estimations and for illustration purposes only. Nedbank Private Wealth is not offering or inviting anyone to conclude transactions and has no obligation to update the information in this communication. While every effort has been made to ensure the accuracy of the information, Nedbank Private Wealth and its employees, directors and agents accept no liability, whether direct, indirect or consequential, arising from any reliance on this information or from any action taken or transaction concluded as a result. Subsequent transactions are subject to the relevant terms and conditions, and all risks, including tax risk, lie with you. Nedbank Private Wealth recommends that, before concluding transactions, you obtain tax, accounting, financial and legal advice. Nedbank Private Wealth includes the following entities: |

Additional Information

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.

Connected Wealth

We connect you to so much more than great advice. We provide insights, technical expertise, global opportunities, and a wide range of solutions and services.